Panhandle Title Loans offer swift financial aid using a borrower's vehicle as collateral, with faster approval times and less stringent requirements than traditional bank loans. Ideal for urgent cash needs like unexpected bills or home repairs, these loans come with higher interest rates and shorter repayment terms, potentially trapping borrowers in debt if not repaid on time. While convenient, exploring all alternatives is crucial to avoid financial strain, especially for those with bad credit or unstable financial histories.

“Panhandle Title Loans: Weighing the Benefits and Burdens

In today’s financial landscape, alternative lending options like Panhandle title loans have gained traction. This type of secured loan uses your vehicle’s title as collateral, offering potential advantages such as quick approval and accessible funds. However, it’s crucial to understand the potential drawbacks and risks involved. From high-interest rates to the risk of repossession, this article provides a comprehensive overview of Panhandle title loans, helping you make informed decisions.”

- Understanding Panhandle Title Loans: A Quick Overview

- Advantages of Taking Out a Panhandle Title Loan

- Potential Drawbacks and Risks to Consider

Understanding Panhandle Title Loans: A Quick Overview

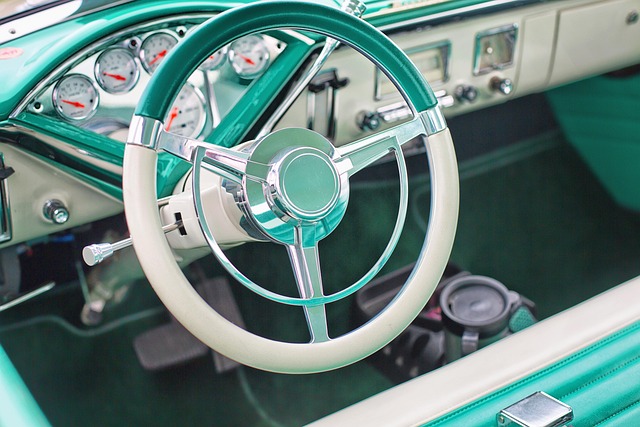

Panhandle Title Loans offer a unique financial solution for individuals seeking quick access to cash. This type of loan is secured against a person’s vehicle, typically their car or truck, serving as collateral. The process involves assessing the value of the vehicle and providing a clear title, ensuring no liens or outstanding debts associated with it. Once approved, borrowers receive a lump sum, with repayment structured over a set period, often shorter than traditional loans. This option appeals to those in need of immediate financial aid, such as covering unexpected expenses or bridging a gap until their next paycheck.

While convenient, Panhandle Title Loans come with considerations. The primary drawback is the potential risk of repossession if borrowers fail to meet repayment terms. Additionally, interest rates can be higher compared to other loan types, making it crucial for borrowers to understand the total cost of borrowing. Unlike San Antonio Loans that offer a broader range of repayment options, Panhandle Title Loans have more stringent requirements, focusing on quick turnaround and vehicle ownership as primary criteria. This makes them less accessible for those without clear titles or needing flexible repayment terms, such as those considering Truck Title Loans.

Advantages of Taking Out a Panhandle Title Loan

Panhandle Title Loans offer a unique financial solution for individuals seeking quick cash. One of the primary advantages is their accessibility; compared to traditional bank loans, the approval process is often faster and more straightforward. Borrowers can secure a loan using their vehicle’s title as collateral, providing a safety net during unforeseen circumstances. This option is particularly appealing to those with less-than-perfect credit or no credit history, as it does not require extensive background checks or stringent eligibility criteria.

Additionally, Panhandle Title Loans provide convenience through direct deposit, ensuring funds are readily available to the borrower. This feature can be a game-changer in urgent financial situations, allowing individuals to pay off unexpected bills, cover emergency expenses, or even invest in necessary home repairs. With such benefits, these loans offer a viable short-term solution for managing cash flow effectively.

Potential Drawbacks and Risks to Consider

While Panhandle title loans can offer a quick solution for those needing fast cash, there are several potential drawbacks and risks to consider. One significant concern is the high-interest rates associated with these loans. Due to their short-term nature and the collateral requirement—typically the vehicle’s title—lenders charge substantial fees, which can lead to a debt cycle if borrowers are unable to repay on time.

Additionally, loan refinancing options are limited for Panhandle title loans. Borrowers with bad credit or an unstable financial history might struggle to find favorable terms elsewhere. This specialized type of lending is designed to target individuals in desperate situations, often exacerbating their financial strain. It’s crucial to explore all alternatives and understand the implications before opting for a Panhandle title loan.

Panhandle title loans can offer quick financial relief for those in need, but it’s crucial to weigh both the advantages and potential drawbacks before making a decision. While these loans provide access to cash with relatively simple eligibility requirements, they come with significant risks, including high-interest rates and the possibility of losing one’s asset if unable to repay. Understanding these factors is essential in navigating the world of Panhandle title loans, ensuring an informed choice that best suits individual financial needs and circumstances.